The Wall Street Journal (WSJ) published an article about Iran's multibillion-dollar trade deals in violation of banned rules during the sanctions period.

The article reads that Iran established a clandestine banking and finance system to handle tens of billions of dollars in annual trade banned under U.S.-led sanctions, enabling Tehran to endure the economic siege and giving it leverage in multilateral nuclear talks, according to Western diplomats, intelligence officials and documents.

The system, which comprises accounts in foreign commercial banks, proxy companies registered outside the country, firms that coordinate the banned trade, and a transaction clearinghouse within Iran, has helped Tehran resist the Biden administration’s pressure to rejoin the 2015 nuclear deal, buying it time to advance its nuclear program even while negotiations were under way.

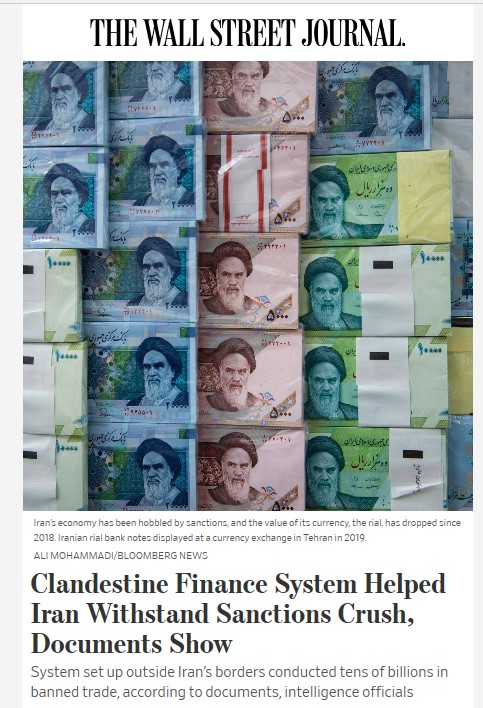

Years of sanctions have hobbled Iran’s economy and caused its currency, the rial, to collapse. But the ability to boost trade roughly to pre-sanction levels has helped the economy rebound after three years of contraction, alleviating domestic political pressure and bolstering Tehran’s negotiating position, say the officials and some analysts.

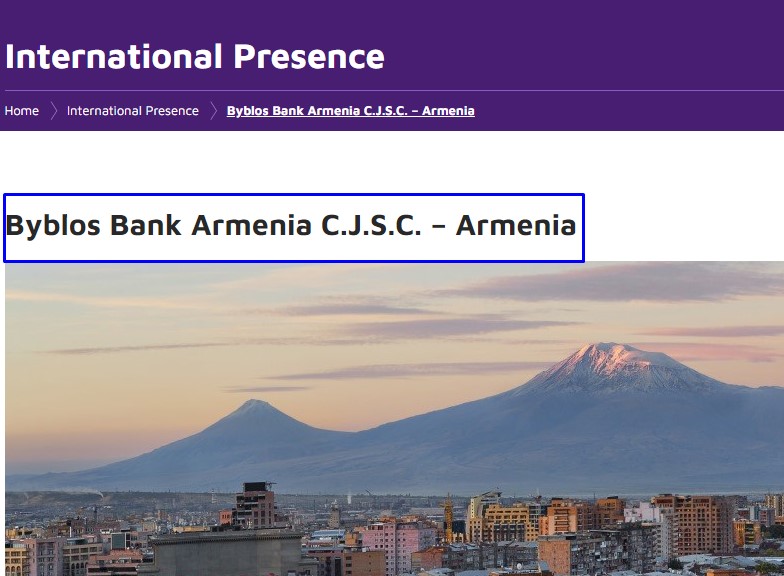

According to the WSJ, the secret system used by Iran to evade sanctions includes foreign bank branches and bank accounts, foreign-registered firms and their joint chambers of commerce in Tehran, and other commercial associations. The fact is that Iran continued its banking and financial operations at that time, even though it was sanctioned by its closest strategic partners. Armenia is one of the first places among them, and it is possible to say enough facts about it.

Although the international financial and banking network cut Iran's connection to the SWIFT system due to sanctions, Iran has "integrated" into Armenian banks and conducted operations in Yerevan in various ways.

Bank Mellat Iran (Bank Mellat), which operates as a branch of Iran in Yerevan, has been particularly active in this process. Although Mellat Bank, which has been operating in Armenia since 1996, provides banking and credit services to small and medium-sized enterprises engaged in trade between Armenia and Iran, as well as Iranian and Armenian tourists, in the following years it turned large commercial enterprises, transport and logistics companies into its customers. The bank also played a key role in attracting frozen Iranian funds. Mellat attracted Iran's frozen assets in Armenia during international sanctions against Iran and increased its capital reserves from 19.3 billion drams to 23 billion drams in the first quarter of 2014. (financialtribune)

Armenian businessmen who export goods to Iran also admit that they regulate their business using Mellat, which operates in Yerevan. The bank's exchange offices convert the Iranian rial into dram and other currencies. Iranian travel agencies also settled their accounts through the bank, as well as Inecobank and Byblos Bank Armenia. (Eurasianet)

Armenia has even openly demonstrated its disregard for sanctions against IDBank. Thousands of Iranian tourists celebrating Novruz and the New Year in Armenia have turned to banks in Yerevan to convert their funds into dollars and euros. The bank has traditionally been closely involved in money laundering as a mediator in Armenia's ongoing trade relations with Iran. The representative of the Central Bank of Armenia Siranush Simonyan also acknowledged the existence of such cases and said that not all commercial banks operating in Armenia have been instructed not to serve Iranian citizens or residents. In particular, IDBank continues to service the accounts of citizens of Iran and other countries and has not imposed any restrictions on the accounts of Iranian customers. The Bank determines its monetary policy only in accordance with the requirements of Armenian law. That is, it ignores international banking law. (Source)

In an article titled " Iran looks to Armenia to skirt bank sanctions," Reuters, the world's leading media outlet, repeatedly spoke of Armenia's secret financial dealings as Tehran's international isolation from the West grew. As a result of its research, the agency concluded that Iran's trade with Armenia continues through cross-border banking. Armenia's ACBA Credit Agricole Bank has openly been a means of settling trade and financial relations with Iran, which has effectively secured Iran's access to SWIFT. The Armenian branch of Iran's Mellat Bank also acts as a bridge in financial and monetary operations. (Reuters)

In its resolution, the UN strongly condemned Bank Mellat's support for terrorism and money laundering. The formation of the Bank's most active financial portfolios in Armenia and Syria really sends a message from very serious and secret issues. It is no secret that the two countries have become a hotbed of illegal arms trade and terrorist financing, as well as money laundering. In this regard, the UN Resolution states that over the past seven years, Bank Mellat has carried out hundreds of millions of dollars in operations for Iran's nuclear, missile and defense enterprises. (Reuters)

The bank had set up a money laundering scheme in both Yerevan and the occupied territories of Azerbaijan. The products acted as food and household goods on the basis of these "business" projects run by Iran were in fact dangerous goods of dubious origin, and the labels of these goods from Iran were changed and sold as Armenian goods in the Russian and European markets under the name of industrial products. The financial intermediaries in this process were Mellat Bank and Markel CJSC. There are reports that the United States had blacklisted these organizations. (Source)

Although one of the sanctioned areas envisages energy programs, the construction of the Armenian-Iranian high-voltage power line has been carried out with the participation of banks on both sides.

The US government has warned that the Armenian banking system violates the requirements of international banking law. The visit of John Bolton, National Security Adviser to the US President, to Yerevan on October 25, 2018, and his meeting with Armenian Prime Minister Nikol Pashinyan, sent a message to the Armenian government not to comply with the sanctions, albeit covertly. Bolton's visit was also attended by experts from the US State and Treasury Departments, who met with the Deputy Governor of the Central Bank of Armenia, as well as private banks and members of the American Chamber of Commerce in Armenia. During the conversation, the Armenian-Iranian issue was in focus as "an important issue." (Source)

Apparently, there is enough information about Armenia's participation in Iran's secret money transactions. Of course, Armenia, a small country, was one of the main centers of secret deals during the sanctions period, but the Wall Street Journal's large-scale currency exchange and multibillion-dollar trade deals cannot be overstated. In this process, of course, other large countries are also involved in the secret banking and financial system created by Iran.

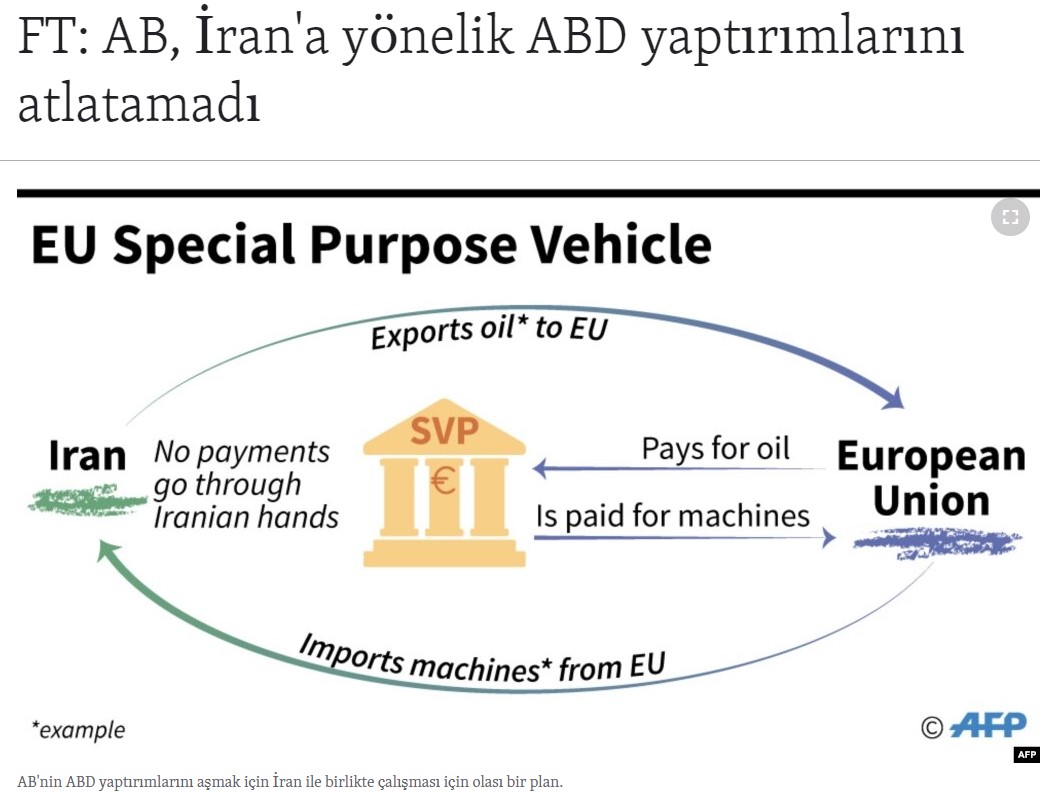

There are several international banks in Iran with annual operations worth billions of dollars. Despite restrictive sanctions on Iran's banking activities, there are enough reports that many European banks have signed multibillion-dollar trade agreements in the country. They include Deutsche Bank, Standard Chartered, BNP Paribas, Banco Santander, Société Générale, ING Bank, HSBC Holdings and others. In fact, these banks explain this by the problem of not losing the business opportunities they have created for thousands of customers in Iran and not fulfilling their obligations to customers. Of course, they left the international financial system (SWIFT) due to US sanctions, but fulfilled their contracts through various subsidiaries. (internationalwealth)

It is no secret that France has very close strategic relations with the Islamic government in Iran. France has been one of Iran's main political and economic pillars in the European Union. France also has the largest number of trade missions, business networks and bank branches in Tehran and other major cities. France is Iran's largest trading partner, with an annual trade turnover of 28 billion euros, but after the sanctions this figure has more than tripled, but the annual turnover remains at 8 billion euros.

Most of Iran's engineering and automotive industries are owned by French companies. The main shareholders of Peugeot and Renault are the French. Ninety percent of Iran's aircraft fleet belongs to French airbuses. Most of these planes were borrowed from Paris-based BNP Paribas. In general, the French financial system is dominated by the French banks BNP Paribas and Societe Generale. As a result, during the sanctions period, BNP Paribas maintained financial ties with Iran, but communication was frozen in 2014 after it was fined $9 billion for violating financial sanctions. However, the parties didn’t take steps that would damage previous relations. The visit of former Iranian President Hassan Rouhani and a number of ministers and business leaders to France in January 2016 was also warmly welcomed. A business forum was held with the participation of the large business community of both countries and economic cooperation was discussed. Iranian Industry Minister Mohammad Reza Nematzadeh told the forum that there were no obstacles for French banks and companies to do business with Iran. (france24)

Tehran has called on French banks to attract foreign investment in the pre-sanctions period, and some of the sanctions have been lifted. Cooperation between the central banks of France and Iran has been officially restored. Coface, France's largest export-credit insurance company, has signed an insurance contract with the Iranian government. (reuters)

Quite interesting, isn't it?

The Tehran government has also gained extensive experience in clandestine oil sales during the sanctions period. Iranian Vice President Eshaq Jahangiri said a few years ago that despite US pressure and sanctions, Iran continues to sell its oil in other ways. (Source)

More than 10 oil tankers have been transported to secret buyers in the Persian Gulf with the help of special radio transmitters that restrict the tracking of oil tankers. Although the main buyers, European countries and South Korea, have completely stopped buying Iranian oil, China has continued to import fuel because it has not joined the sanctions. However, this was done not in secret, but through normal market operations. China realized this by exchanging its ships for Iranian tankers. India, a secret buyer of Iranian oil, has also played a key role, and Delhi, which enjoys US-recognized concessions, has secretly increased its oil imports from Iran.

Russia, on the other hand, has acted as a guarantor for the transportation of Iranian oil to the world market without joining any of the sanctions. Due to the similar composition and quality of Iranian and Russian oil, the Russians sold the fuel as their own oil to European refineries. As a result, oil sales from Russia to Europe increased significantly in 2017-2018. As for the deals, various options were used to cover the cost of oil, food and technological equipment, gold, etc. exchanges were made with the goods. (Source)

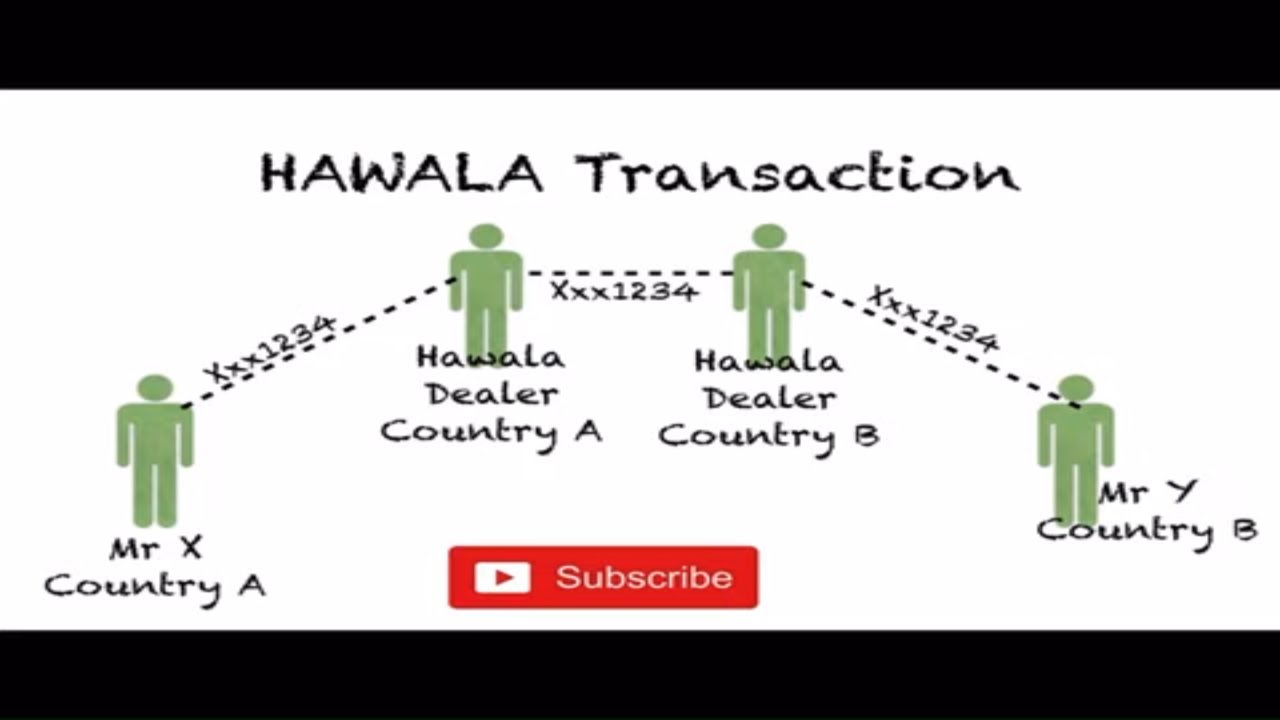

Thus, despite the separation of Iranian banks from the SWIFT system, it was able to maintain trade with oil-consuming countries and, by finding various schemes and mechanisms, provided remittances to the country by subsidiaries and foreign counterparties. The money circulation scheme is based on bank branches in Armenia-Russia, the Middle East and Southeast Asia. The transfer of rubles, dollars or euros to Iran by Iranian banks through the offices of MirBusinessBank in Russia, Tejarate Iran in Tajikistan or TK Bank in Belarus is carried out without the use of the SWIFT system. The Hawala system is considered more reliable in transfers. In Iran, this service is available at almost all Sarafi exchange offices, which exchange the Iranian rial at a free exchange rate.

Also, there are no serious restrictions on the use of VISA and Master Card in Iran, and it is possible to use these bank cards in many outlets in the country, mainly in carpet sales, tourist centers and some hotels. As VISA and MasterCard payment terminals belong to banks in Dubai, banking services are provided by transfers to the accounts of companies located in the UAE. (Source)

Iran's current "experience" suggests that, despite US and Western sanctions, it is possible to conduct "coordinated" money transactions through various secret financial channels through foreign commercial banks and intermediaries registered abroad. In this regard, it seems that illegal deals evading sanctions against Russia are not limited to Moscow.