Armenia's Economy Minister Vahan Kerobyan has recently said that food-security risks and the resulting high inflation are expected to increase the poverty level across the country by the end of the year.

"If we fail to ensure fair distribution of the growth among all layers of the population, and if the income of people from vulnerable groups does not grow, we will have the current poverty rate of 27% to soar to 42% by the end of the year," the minister said in an interview with the Public Television of Armenia.

Kerobyan explained that the consumer basket is becoming more expensive, and another 15% of the population will be below the poverty line. According to official statistics, the 12-month inflation in Armenia's consumer market in late March 2022 was 7.4%.

The government’s growth projection for 2022 is 7%, and the inflation is set at 4% (± 1.5%). Earlier, the Central Bank revised its growth forecast for 2022 1.6% from an earlier projection of 5.3%. ($1 - 476.92 drams)

Faktyoxla Lab. has tried to figure out how plausible these statements of the Armenian minister were.

Let's start with the fact that, judging by the figures and forecasts of international rating agencies, the economic situation in Armenia is tense and there are all prerequisites for its further deterioration. If we take into account that Armenian officials often like to misrepresent numbers to calm their own population, then in reality the situation will look even worse. This is a reality from which Armenia cannot escape.

The same Armenian minister recently stated the following: “As for rating agencies, when there are many uncertainties, they begin to sharply reduce their forecasts. I know that international financial institutions do this too. When we discuss methodology with them, how they do it, they usually say: “Maybe such and such a scenario is realized.” That is, they always take the most negative options under uncertainties and put it in a new forecast, let's say so.

Now let’s consider the forecasts of international agencies and organizations.

1.Moody's Investors Service (Moody's)

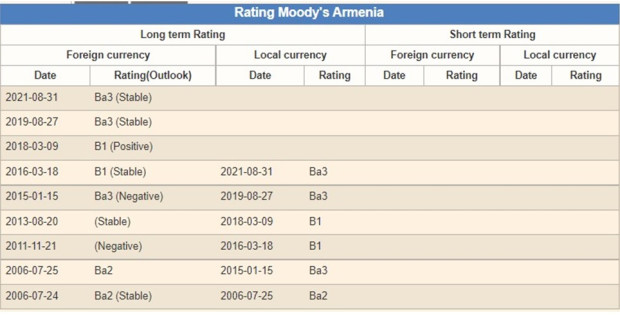

On March 24, 2022, Moody's Investors Service (Moody's) revised the creditworthiness of the Armenian Government, approving the rating for long-term issuers in local and foreign currencies at the level of Ba3, as well as high indicators unsecured by foreign currency.

Moody's changed its outlook from stable to negative. The last time Armenia registered the same credit rating was in 2015, when the Russian economy was once again in the doldrums.

Pressure reflects Armenia's relatively high economic linkages with Russia, whose economy Moody's expects to contract sharply in the aftermath of the country's invasion of Ukraine. Armenia's exports to Russia account for about 6% of GDP, while remittances from Russia also represent roughly 6% of GDP.

The revised forecasts are driven by Moody's expectations that remittances will decline, amid an economic contraction in Russia and a depreciation of the ruble. Moody's expects total remittances (including from other sources) to contract by 20-30% in 2022, against earlier expectation for remittances to stay roughly flat. This will weigh on Armenian household consumption. In addition, export growth will also likely stall from lower demand from Russia, further weighing on real GDP growth.

In the longer term, Armenia's growth potential may weaken. This risk reflects Moody's view that international sanctions on Russia will remain for an extended period of time. As a result, remittances from Russia and exports to Russia are unlikely to recover to previous levels. Armenia's economic resilience to this shock will depend on the effectiveness of policies that may help absorb it. Armenia's fiscal profile is also exposed to currency risks, with 70% of its debt denominated in foreign currency. While not our baseline assumption, a sharp depreciation in the dram would worsen the government debt trajectory, while also increasing banking sector risks given the still-high levels of dollarization.

2.Standard & Poor's

The international rating agency Standard & Poor’s (S&P, headquartered in New York) on April 11 this year maintained Armenia’s credit ratings at B+ and B for short- and long-term bonds in foreign and national currencies, respectively. Armenia's GDP forecast for 2022 has been reduced from 4.7% to 1.3%, taking into account the situation in Ukraine and the economic downturn in Russia as a result of Western sanctions (by the end of the year it is expected to be 8.5%). Russia is the main investor and trading partner of Armenia, accounting for 28% of exports and 37% of imports of the republic.

Armenia's external security risks also remain, according to the current S&P assessment. Due to rising inflation, the Central Bank of Armenia may have to further increase interest rates, S&P experts state. Armenia's external account deficit will worsen due to rising food prices. The growth of world prices for non-ferrous metals (Armenia exports copper and molybdenum concentrate) will not be able to fully cover this deficit. At the same time, it should be taken into account that gas from Russia is imported by Armenia under long-term fixed contracts and at prices below market prices, S&P notes.

3.Fitch Ratings

The international rating agency Fitch Ratings has sharply lowered its forecast for the growth of the Armenian economy The Fitch rating agency was the first to sharply reduce the forecast for the growth of the Armenian economy, replacing the initially indicated 5.3% by 1.3%.

“Constraints related to the conflict in Ukraine and sanctions on Russia have forced us to drastically revise our economic growth forecast for 2022 downwards as export growth (especially to Russia) has stalled and remittances (hence household consumption) decline,” the agency said.

At the same time, Fitch analysts predict that in 2023 the growth of the Armenian economy will reach 4.2%. The agency also cites some statistical data that directly indicate a certain dependence of Armenia on the economic situation in Russia. Thus, as of 2021, Russia accounted for 28% of exports of goods, 37% of imports and 40% of tourist visits, foreign direct investment and remittances to Armenia.

Following Fitch, the forecast for Armenia was also revised by the International Monetary Fund.

“Although there is considerable uncertainty about the extent of the impact of the ongoing processes on Armenia, since the situation is still developing, according to our preliminary assessment, in 2022 the economy of the republic will still show some growth. But this growth will be about 1.5%, which is much lower than previously expected”.

“The immediate impact of sharply higher natural gas prices will be limited, given that Armenia has locked in gas import prices with Russia as of December 2021, for multiple years. Some disruption to trade relationships is likely given the loss of correspondent banking relationships of Russian banks operating in Armenia. Russia's deep recession and the large depreciation of the Russian rouble will hit Armenian exports,” reads the report.

4.World Bank

The World Bank lowered its growth forecast for the Armenian economy to 1.2% and expects GDP to recover to 4.6% in 2023 and 4.9% in 2024, reads the WB spring forecast on economic developments in the Europe and Central Asia region (Europe and Central Asia Economic Update, Spring 2022). In its January report, the WB forecast for the growth of the Armenian economy for 2022 was 4.8%, and for 2023 - 5.4%.

“The World Bank has downgraded its growth forecast for Armenia for 2022 from 5.3 percent pre-war to 1.2 percent, with lower remittances and real wages impacting consumption; heightened uncertainty impacting investment; and exports contracting due to the projected contraction in Russia and slowing global and regional growth,” reads the report. According to the World Bank's Europe and Central Asia Economic Update, Spring 2022 report, Armenia's agriculture will continue to be weighed down by structural challenges; industry will be impacted severely by uncertainty; and services will slow along with consumption. In the medium term, growth is expected to pick up in 2023 and 2024, but at a slower pace than projected pre-war. In line with slower growth, revenue collection is expected to decline, and spending pressures are expected to rise, particularly through increased social assistance, leading to a delay in fiscal consolidation. This will push up the debt to GDP to about 67 percent of GDP at the end of 2022, further away from statutory limits.

According to the report, the current account deficit is projected to widen due to lower exports and net remittances. Exports may be boosted by increased tourism revenue associated with an inflow of Russian citizens following the onset of the war.

5.Asian Development Bank (ADB)

The Asian Development Bank (ADB) expects Armenia’s economic growth to slow to 2.8% in 2022 and then, if the impact of economic shocks eases, to recover to 3.8% in 2023.

"Geopolitical developments leave the economic outlook highly uncertain and pose serious downside risks to growth primarily because of Armenia’s economic exposure to the Russian Federation, which provides about one-third of its trade, half of its remittances and 40% of its foreign direct investment," ADB said in its April's Asian Development Outlook report.

According to the report, domestic factors supporting growth, include a planned 50% increase in capital spending in the 2022 budget, accelerated vaccination coverage, and economic and structural reforms outlined in the 2021-2026 program aimed at developing a more knowledge-based, export- and investment-driven economy.

ADB analysts forecast that industry, excluding construction, will grow 0.5% in 2022 and 2.5% in 2023 as utilities and manufacturing continue to expand.

Agriculture is expected to grow 2.5% in 2022 and 3.5% in 2023, assuming normal weather and higher spending on government programs offering subsidies for smart livestock facilities, intensive orchards, crop protection hail nets and drip irrigation, and efforts to increase productivity and commercialization.

Although the economy is less dependent on remittances than in previous years, lower remittance inflows from Russia and higher inflation are expected to limit private consumption growth to 2.5% in 2022 before accelerating to 3.8% in 2023 as inflation slows somewhat.

By the way, in March of this year, the IMF worsened its December forecast (5.5%) for the growth of the Armenian economy to 1.5%, and the EBRD in March worsened its forecast for the growth of the Armenian economy for 2022 from 5.3% (in November 2021 year) to 1.6%. At the same time, for 2023, it is predicted that the Armenian economy will grow by 4%.

Why such disappointing forecasts regarding the future of Armenia?

For example, in 2020, due to the COVID-19 pandemic and travel restrictions, many Armenian guest workers stayed at home. But agricultural production in Armenia that year registered a drop of over 4% compared to the previous year. This area remained in the red at the end of 2021 - 98.9%.

There are also poor prospects for industry. In the past year, the general industry in Armenia was largely kept from falling only by growth in the mining industry, however, in the last months of 2021, it was increasingly fading away. Thus, according to the results of the whole last year, the industry, traditional driver for the Armenian industry, completely became negative (99.2%). Armenian experts note that this year the already bleak situation in the mining industry will be aggravated due to the shutdown of the large Teghout CJSC. It is unlikely that the entire possible influx of tourists from Russia (another hope of the government) is able to compensate for the shutdown of this one enterprise.

As for trade and services, the expectation of a drop in turnover in these areas is due to a reduction in cash transfers from the same migrant individuals, which will lead to a reduction in demand. The head of the Central Bank Martin Galstyan believes that the volume of money transfers to Armenia will fall by 20%, while Finance Minister Tigran Khachatryan speaks of a reduction in the inflow of private financial resources by 40-50%.

We must not forget that the unprecedented scale of Western sanctions against Russia and Belarus could not but affect the countries of the Eurasian Economic Union, which includes Armenia, due to the deep interconnectedness of the economies of these countries within the single market.

There are other factors that influenced the situation in Armenia:

- the defeat of Armenia in the second Karabakh war in the fall of 2020. The fact is that Armenia has lost 26% of wheat sown areas, 14 mines, 30 hydroelectric stations and many other things in the previously occupied Azerbaijani territories;

- economic growth is constrained by the unattractiveness of Armenia in terms of investment. Armenia has no access to the sea, the population is small and the country is located in a very difficult turbulent region, which is generally not considered by anyone in the world as a suitable place for investment;

- The state budget of Armenia is almost always in deficit, and in order to maintain it, one has to borrow, which is an unhealthy situation. A significant part of the Armenian budget accounts for debt servicing. To achieve fiscal stability, Armenia does not have a budget surplus.

But there is a way out of this situation.

After the normalization of Yerevan's relations with Baku and Ankara, economic growth will begin in Armenia, Anton Bredikhin, scientific director of the Center for Ethnic and International Studies, editor-in-chief of the "Archon" magazine, has recently said. “The consequence of the normalization of Yerevan's relations with Baku and Ankara will be, first of all, the growth of economic well-being in Armenia. The poor economic situation in the country is the main reason why Armenians leave the country en masse and go mainly to Russia. Naturally, such an improvement will attract the support of the Armenian society, and therefore the normalization of relations with neighbors will be welcomed by the majority of the country's population,” the expert said.

However, does the political leadership of Armenia have enough political will to normalize relations with neighbors? This is just a matter of time...